My income tax can save lives? How dollar-for-dollar tax credit donations work.

Support Teen Lifeline directly with your Arizona Personal Income Tax payment

No one likes to owe money on taxes. But if you do, wouldn’t it feel better to use that money to support the causes you care about?

With a charitable contribution tax credit, you can.

What is a charitable contribution tax credit?

A tax credit is an expense that taxpayers can subtract, dollar-for-dollar, from the amount they owe on income taxes.

There are several categories of tax credits, such as child and dependent care, educational, health savings account, etc. Better yet, you can claim multiple types of tax credits at the same time without them canceling each other out. (For example, you can claim a charitable contribution tax credit and a public school tax credit at the same time).

If you donate money to an officially-recognized nonprofit organization (called a Qualifying Charitable Organization, or QCO) on or before Tax Day on April 18, you can claim that donation as a charitable contribution tax credit. This is a dollar-for-dollar tax credit that reduces your tax liability. In Arizona, you can claim up to $400 filing single/$800 filing jointly as a charitable contribution tax credit.

The purpose of charitable contribution tax credits is to give taxpayers more choice in how their tax dollars are invested back into their community. Charitable contribution tax credit donations are an important source of funding many nonprofits rely on to maintain and improve their services.

As an Arizona-based organization, in this article we focus on how charitable contribution tax credits work in Arizona. However, many of these points are applicable elsewhere in the United States.

“I feel great giving to an organization staffed by teen volunteers helping to make such a meaningful impact with other teenagers in times of crises.”

— Colin, a Teen Lifeline donor

How do I claim my Arizona Tax Credit?

Since the Arizona Department of Revenue has classified Teen Lifeline in the category of Qualifying Charitable Organizations (QCO), it means that a portion of your Arizona Personal Income Tax payment can be directed to Teen Lifeline, as opposed to your state tax payment going solely into the Arizona General Fund.

The maximum credit of $800 is allowed for married couples filing joint returns. Single, head of household, and married individuals filing separate returns can claim a maximum $400 credit.

In order to claim your Arizona tax credit, you must complete Arizona Form 321 and submit it along with your other tax return documents. The QCO code for Teen Lifeline is 20695.

Here’s what the process looks like:

- Donate to a certified charitable organization (like Teen Lifeline!).

- Keep a receipt of your donation from the charity to include in your tax return.

- Complete Arizona Form 321 for each charitable contribution tax credit you want to claim. You must include the Qualifying Charitable Organization’s code in this document (Here’s the official 2022 list of QCO codes from the Arizona Department of Revenue). Teen Lifeline’s QCO code is 20695.

- Calculate your individual tax return. Subtract all your tax credits from what you owe on taxes, making sure to include the relevant forms when filing (i.e. Arizona Form 321).

Is there a minimum amount I have to donate for it to count?

Nope! You can donate to Teen Lifeline in any dollar amount—we would even appreciate a gift of $10, $25, or $50—and the amount of your donation can be applied as an Arizona tax credit as long as you make your gift on or before April 18 and complete and submit Arizona Form 321 along with your tax returns.

What if I donated to multiple nonprofit organizations?

Every donation to a certified nonprofit counts. You may receive an Arizona tax credit for making donations to more than one qualifying organization during the same tax year.

Let’s say you are filing a single tax return and you owe the State of Arizona $1,000. You could donate up to a maximum of $400 to Teen Lifeline, and then divide the remainder of your $600 balance into donations to other QCOs in any amounts that do not exceed $400.

What if I go over the maximum tax credit limit?

It still counts! You can still get a tax reduction for amounts that exceed that $400 or $800 limit—you just may have to wait until next year to apply it.

The amount of your donation that exceeds your $400 or $800 limit can be carried over to future years as an Arizona tax credit for a period of up to five years—as long as the total amount of your QCO donations does not exceed your total Arizona tax liability for the year.

For example, if you are filing a single return and you owe the state $500, you can make a $500 gift to Teen Lifeline and $400 could be applied to your 2021 tax liability and the remaining $100 balance could be carried over as an Arizona tax credit for next year.

Where can I learn more?

More information about Contributions to QCOs is available on the Arizona Department of Revenue website.

Please consult with your personal tax advisor for individual advice regarding your individual tax situation. This article has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, individualized tax, legal, or accounting advice.

We appreciate your generosity!

Your tax-deductible donations are helping our dedicated volunteer teen peer counselors and staff save lives every day. Thank you!

Here are a few ways your donation to Teen Lifeline helps teens:

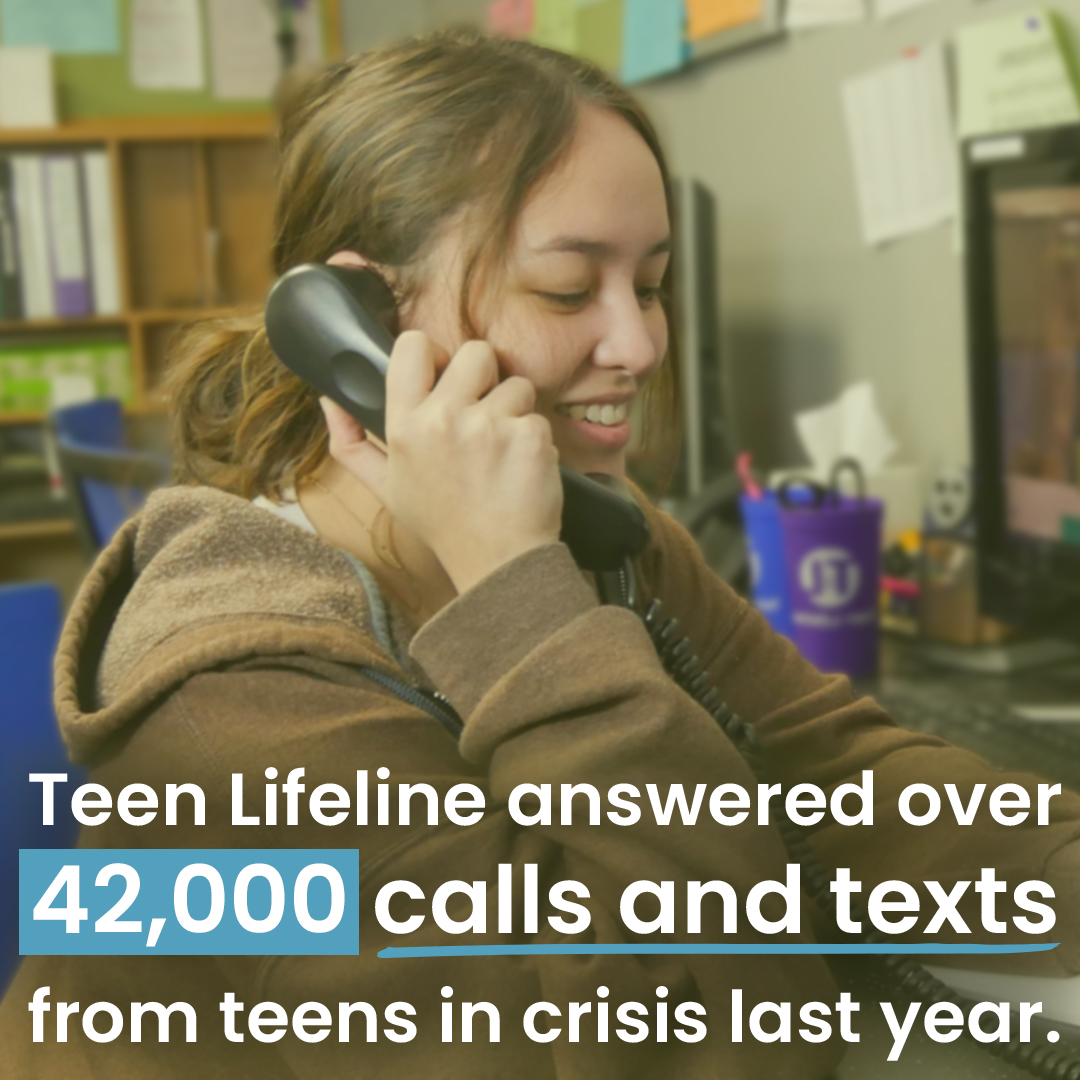

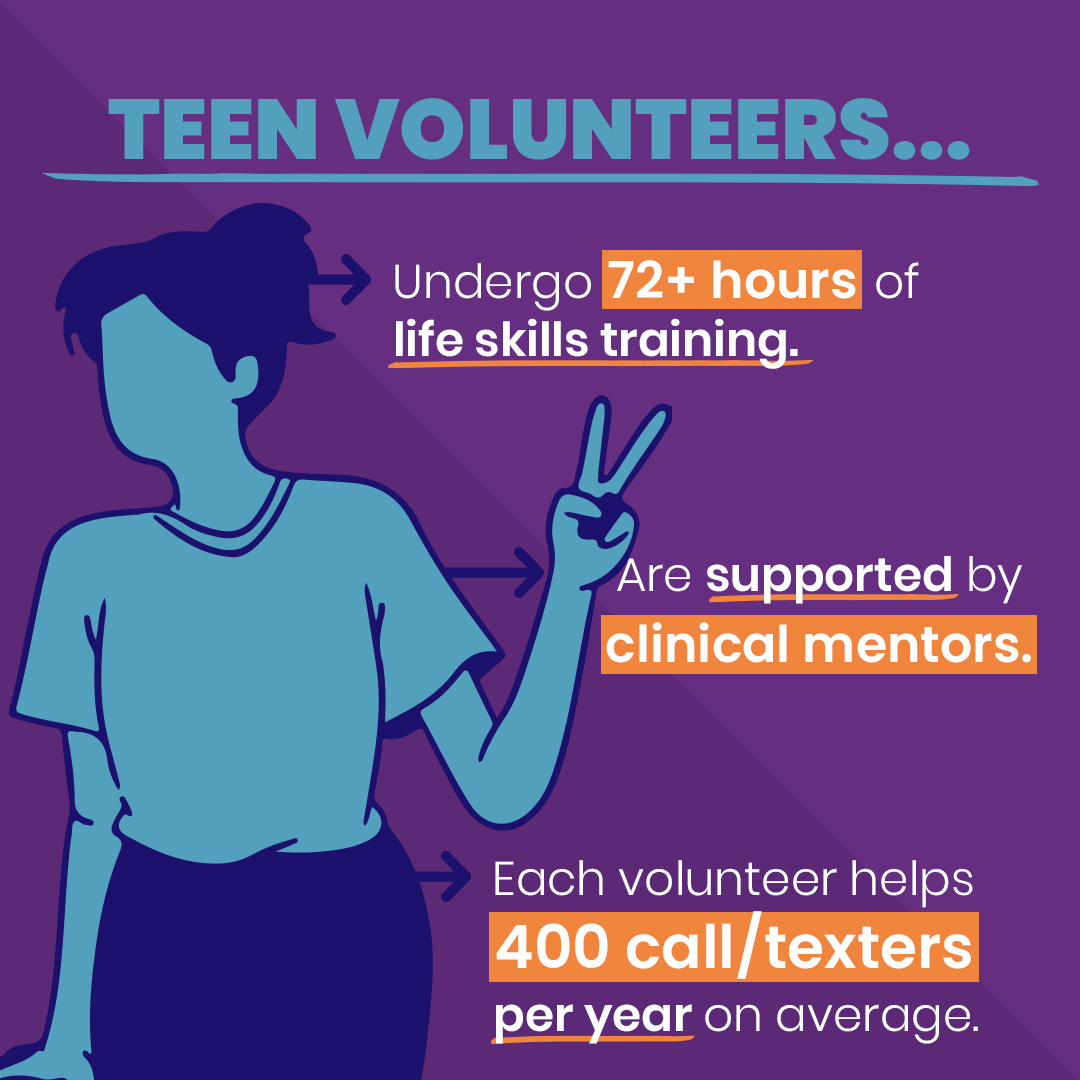

Research shows teens will go to another teen for help first before they’ll go to an adult. Our 24-hour free and confidential peer counseling crisis hotline/textline is answered by trained teen volunteers 3 – 9 p.m. daily and is supervised by master’s level clinicians.

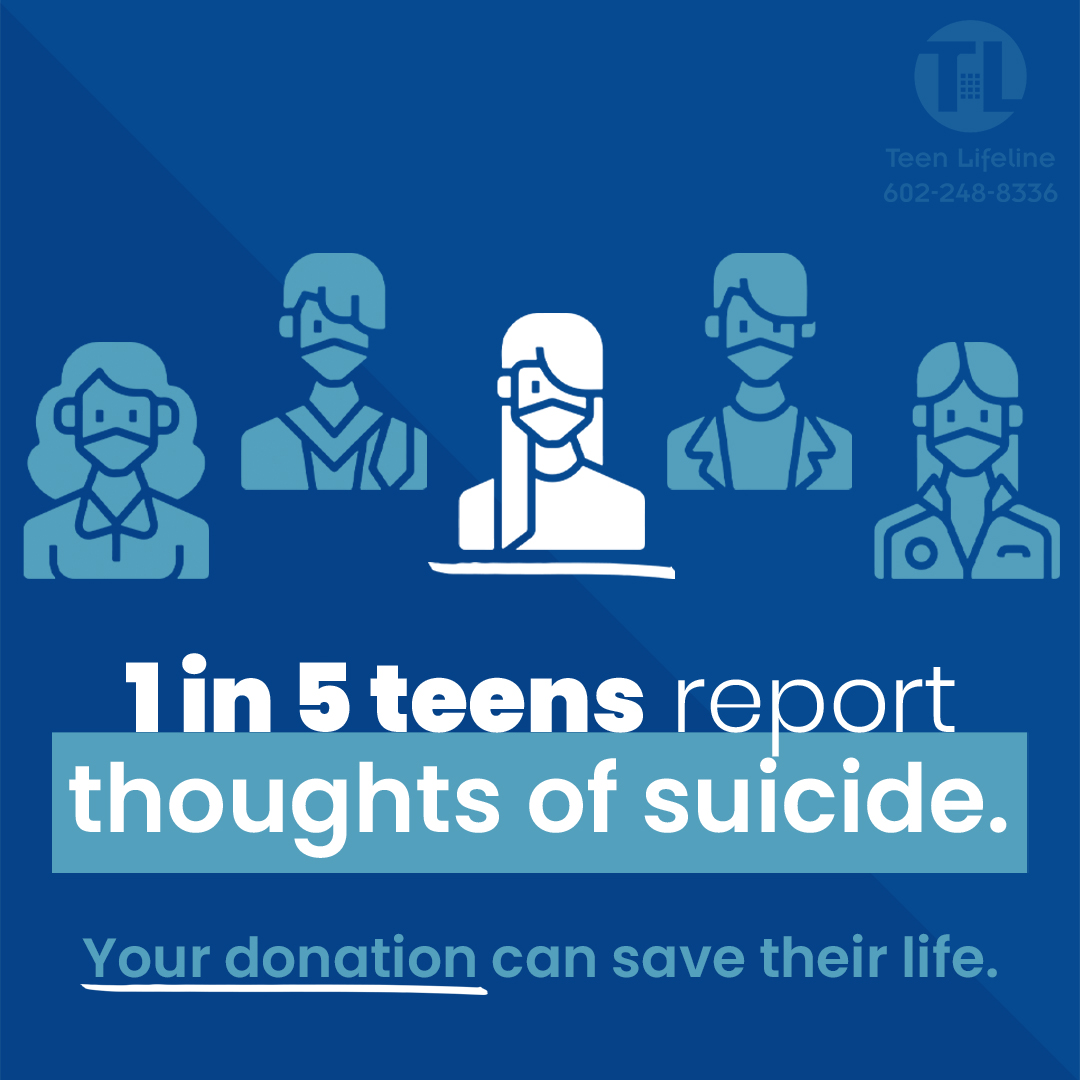

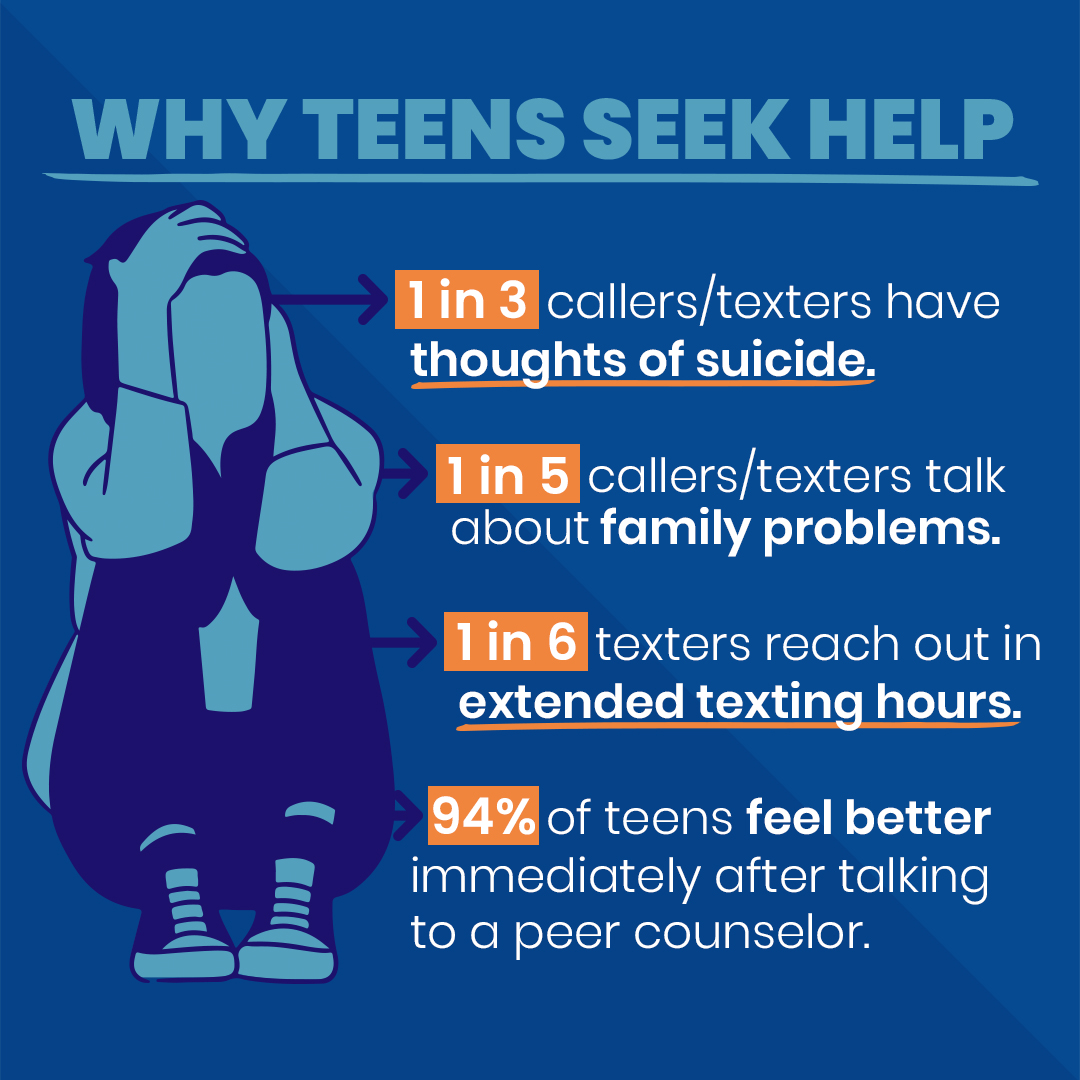

In 2021, Teen Lifeline answered over 42,000 calls and texts—a nearly 50% increase since before the pandemic. Considering 1 in 3 calls/texts involved thoughts of suicide, peer counselors helped about 14,000 callers/texters safely through a suicidal crisis.

- A $35 donation supports an hour of peer counselor training.

- A $100 donation funds a hotline text conversation.

- A $250 donation answers a hotline call.

Ready to make your tax credit donation?

Donate to Teen Lifeline by or before Monday, April 18, 2022, to claim a charitable contribution tax credit on your 2021 taxes at teenlifeline.org/give.